I was on vacation when I saw the news of layoffs by HGST and it struck deep in me as I have also heard about friends and clients whom were layoff in the financial sector since last year. This is definitely not the most desired way to end 2013 and start 2014. I hope they have a healthy balance sheet(family) to see them through during these period and that they can find employment in 2014. This further reinforced that one should prepare himself/herself financially so that in the event such a unfortunate thing happen, it is not the end of the world.

As we moved into the last trading day of 2013, I would like to share some of the lessons learnt over the last 12 months.

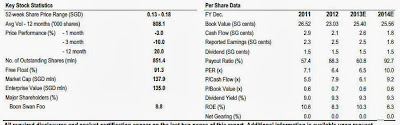

Risk and Rewards. Dr Tony Tan once said, and I quote 'when you take care of the downside, the upside will take care of itself'. How wise is the statement, and many times, it has worked for me for those shares that I have bought below their NAV and low PE. Taking care of the risk also means that one needs to cut loss if it does not turn out to be in the direction that you have set out to be. Cutting loss is important as you keep your loss to the minimum so that the profits from the other counters can help to reduce the impact to your overall portfolio.

Know Thyself. Not everyone can be both a trader and an investor. My definition of a trader is one who buys and sells share based on TA, solely TA, and that he/she does not keep shares for long period of time(more than 2 to 4 weeks). An investor is one who uses FA to select the stocks that he/she wants to buy and then uses TA to time the entry and exit from the market. I know where i belong to after having my loss when I tried trading.

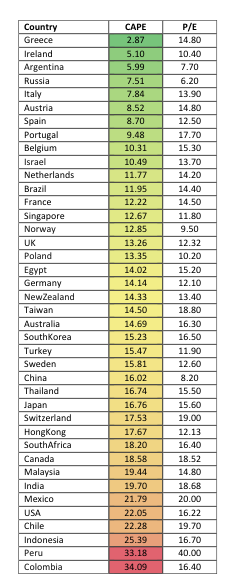

Diversify. Although some people said that you dont know what you are investing if you have a diversification of portfolio. I have said this many times, I am not expert so I cant be putting all my eggs into one basket(and besides most of the experts were also wrong during the Lehman crashed) and therefore I need to learn from someone who has proven track record. Walter Schloss holds a portfolio of stocks using his own selection which he has shared and for 45 years, his fund has produced a healthy return of 15.3%. This is very impressive considering that it has beaten S&P500 which has recorded 10% for the same period of time. And besides, the penny crashed that we had in October, can you imagine if you have put all your savings into one of these counter, Blumont Group Ltd, Asiasons Capital Ltd and LionGold Corp Ltd.

Be Patient. I too made this mistake of buying too early, just like most of the investors. I have to constantly remind myself that sometime it is worthwhile just to wait for a few more days before deciding again whether to enter the market. To mitigate this, for the past few counters, I have been entering that market in batches using TA.

In less than 15hrs, we will be starting 2014, what is your investment strategy moving into the new year ...