Howard Marks is a veteran investor and co-chairman of Oaktree Capital Management. He published his memo about his observations and thoughts on the market, and they are widely read by many investors, including Warren Buffet. In his recent memo and interviews, he mentioned that the credit market offers a better deal now than equities. After some research, I found these 2 Etfs, one is listed in the Singapore Stock Exchange and one listed in London Stock Exchange, so that investors will not be subjected to the 30% tax.

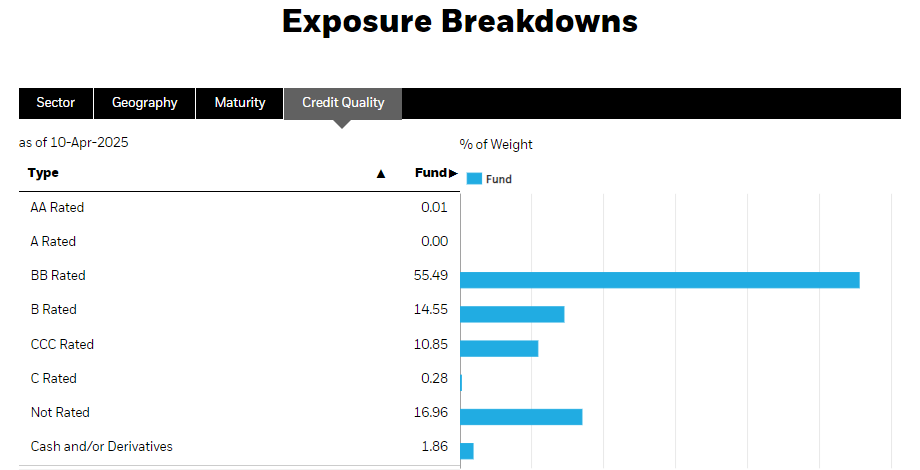

These should not be the core portfolio but satellite ones just to augment the main core portfolio, and they should not be more than 5% of your entire portfolio. Again this depends on your risk appetite. These are non-investment grade bonds (rated BB and below) and therefore the probability of default is higher. However, to mitigate this risk, using ETF does help as it is a basket of bonds.

iShares USD Asia High Yield Bond ETF (QL3)

This is listed in SGX, domiciled in Singapore. The fund size is huge, meaning there is liquidity, and after the market volatility last few weeks, the yield is higher now.

iShares Broad $ High Yield Corp Bond UCITS ETF (HYUS)

This bond Etf is fairly new, inception in 2022 and is listed in the LSE, and domiciled in Ireland, bond yield of more than 8%.

I owned these 2 Etfs, this post is not an advice to buy or sell.

No comments:

Post a Comment