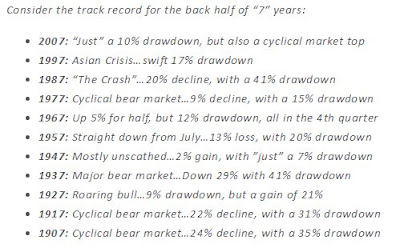

Time.com called it the 130 year old curse of the stock market, and it is referring to the unlucky 7. For full article, please refer to here. Why unlucky 7? If you looked at the historic of the US markets, during these periods of 2007, 1997, 1987 and 1907, these were the bear market with the biggest correction.

Expanding on the above, Dana Lyons, a partner at J.Lyons Fund Management wrote a blog post with the observation of the magnitude of the correction for each of these periods and more. You can read more of his blog post here.

Below is a tabulated extract from his post.

Few more weeks and we will be out of 2017, and the curse will be broken?

Sunday, 3 December 2017

Wednesday, 6 September 2017

The simplest way to forecast expected return of the market

Recently I saw an interview below on John Bogle asking his view on the current market, and I thought it was really an interesting and simple way of using it as a guide. John Bogle, who is the founder of the Vanguard Group, shared this method which he had been using for some time. You can find the full video here.

Essentially, it consists of 2 main concepts; of

Essentially, it consists of 2 main concepts; of

Investment Returns + Speculative Returns

Dividend Yield + Earning Growth +/- Change in PE ratio

Investment Returns = Dividend Yield + Earning Growth

Speculative Returns is the change in emotion of people in the market on how much they are willing to pay.

John Bogle also admitted that no one can predict the future, however he advised investors to stay on course, don't move money here and there, and keep investment simple. These are very good advice.

Sunday, 16 July 2017

Investor Sentiments (July 2017)

How many of us still remember the Asia Financial Crisis which started out of Thailand in 1997? Fast forward, this year is the 20th year since it happened. And today, most of the markets, apart from China, is hitting all time high. Both our sovereign funds released their result last week and they also observed that it is getting difficult to find value in the current market.

Fear and Greed index from CNN money and sentiment survey from AAII.

Fear and Greed index from CNN money and sentiment survey from AAII.

Monday, 1 May 2017

Magic formula screen for Singapore stocks - 2

Happy Holiday and long weekend to all, it's been more than 6 months since I last posted the Magic formula screen for Singapore stocks. Let's take a look at the results if you were to invest in the list of stocks back then and the returns from these counters now. A slight change to the previous list was I have added SPH to the list.

On the last column, it shows the percentage returns of each of the counter, Green indicates that it is a gain and Red means it is a loss. We are already halfway mark into the year, how does your portfolio perform.

On the last column, it shows the percentage returns of each of the counter, Green indicates that it is a gain and Red means it is a loss. We are already halfway mark into the year, how does your portfolio perform.

Sunday, 16 April 2017

Are these stocks potential turnaround?

As the market continue to rise, there are not many cheap stocks to buy and invest in. With this in mind, I thought I will try on short term for a potential turnaround. While the whole world was worried about the Mad Fat Boy launching a missile, I was checking the past few weeks a few counters (including the below) and the TA looks pretty convincing,

What do you think of the below, both cut across the 200MA, you think got chance?

What do you think of the below, both cut across the 200MA, you think got chance?

Sunday, 19 March 2017

Recent action - UMS and Keppel Corp

Despite the recent rate hike, the market continued to hitting new high. Since the beginning of this year, I have been reviewing my current portfolio, selling the weaker ones and taking some profit on the strong counters. After the last GFC, I felt that it is better to realise some hard profits and keep them in my pocket than to see them vaporising on paper.

Last week, I finally took the hard decision to cut loss on my Kepcorp. This was a counter which I bought at quite a high price, and when it corrected, I should have adhered to my usual cut loss of 20%, but I didnt and thus a price to pay. I have taken the decision to cut loss so that I can redeploy the capital to other counters that I am watching now.

At the same time, I have also taken profit on UMS. The stock price awoken due to more investors taking notice on this counter and buying it for its' decent dividend (I presumed). I was told to leave the party when it gets crowded, although after I sold, it went up some more. UMS was a counter which I hold since 2015, and over the years, it has given me pretty good dividend. With the recent run up, I pared down my holdings and left with just 1/3 of it. The remaining 1/3 is at ZERO cost to me now, thus even if the share price corrects, I can still sleep well at night. Once again, this also tells me that both 'Timing the market' and 'Time in the market' are equally important.

Lastly, as the market continue to rise, it has been challenging to find value in the market. I am looking at a few (some can be found in my list using the Greenblatt formula) and will be sharing shortly.

Sunday, 5 March 2017

I took profit for these 2 counters

President Donald Trump has done it again, through his latest speech, it had resulted in DOW JONES hitting new high and thus rallying along the rest of the world indices including STI and blue chips.

STI ETF

STI has a good run since last year, it has given me more than 5% gain (excluding the dividends). From the TA indicators, it is in the over-bought zone, I thought it will be better to take some profit first. I still keep some shares as it gives me quite decent dividend yield. An interesting thing I observed in the chart below, in Apr 2011 and May 2015, there was a huge surge in volume and few weeks later, the STI index corrected. Last week, we saw the same huge volume surge, will it happen in the next few weeks?

DBS Bank

I have also profit take and sold off my DBS holdings, it has been the star performer for me in 2017. The decision to sell for this counter is more maths than anything else. The average dividend over 10 years is 0.614cents. Based on 30 times, anything more than $18 is considered not cheap(last week it rallied above $19). The stock price may still go up further, nobody knows. But I will leave that last part to those with a strong heart.

In 2017 and beyond, we are expecting the market to be volatile and there will be many uncertainties, guess at some point we should take some profit off the table. After all, we invest because we want to make our money work, and if we dont take profit, we are not doing justice to our $$. Just my own views.

Sunday, 12 February 2017

My First buy in 2017

These 2 stocks have been on my radar for some time, and I was waiting for market to present an opportunity for me to buy them. Last week, there were some heartbeat from these 2 stocks and I made my first buy for 2017.

The first counter which I bought was Mapletree GCC trust. I am wary of the interest rate increase this year which many people spoke about, and that this will affect stocks like Reits and Trusts. The problem with this is that when many people are talking about it, most of the time it didnt happen :). I wanted to have some exposure outside Singapore, and this counter I thought fits well.

Fundamentally, it's still below the book value, debt is still within the managed range and the dividend is good. There were many articles on China facing a slow down, I guess I will leave this to the economists.

From TA, it has tested few support levels and last week, it has broken the neckline resistance of 0.97c. It is still below the 200d MA, which is the next major resistance. I guess I am ok, just wait and collect dividend first. :)

The 2nd counter which I bought was YZJ. Shipping has been unloved by many for the longest time now, fundamentally, its still below the book value and paying a decent dividend.

Lastly, the above is my no means recommendation of any sort, it's just a record for me to validate against my method in years to come.

Subscribe to:

Posts (Atom)