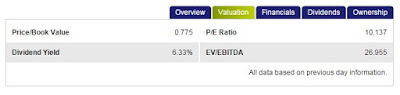

Pulling the data from the stockfact from sgx.com, the PB and div looks pretty decent.

Using the same portal, if you sort the Reits by div yield, you get the below. In a rising interest rate environment, you would want to make sure that the debts are not high, and CCT meet this criteria.

Take a look at TA, would the trend change if it is able to break and stay above $1.35? Please use your own judgement as I am not a certified professional.

No comments:

Post a Comment