Time.com called it the 130 year old curse of the stock market, and it is referring to the unlucky 7. For full article, please refer to here. Why unlucky 7? If you looked at the historic of the US markets, during these periods of 2007, 1997, 1987 and 1907, these were the bear market with the biggest correction.

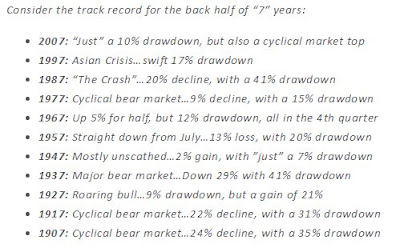

Expanding on the above, Dana Lyons, a partner at J.Lyons Fund Management wrote a blog post with the observation of the magnitude of the correction for each of these periods and more. You can read more of his blog post here.

Below is a tabulated extract from his post.

Few more weeks and we will be out of 2017, and the curse will be broken?

Sunday, 3 December 2017

Wednesday, 6 September 2017

The simplest way to forecast expected return of the market

Recently I saw an interview below on John Bogle asking his view on the current market, and I thought it was really an interesting and simple way of using it as a guide. John Bogle, who is the founder of the Vanguard Group, shared this method which he had been using for some time. You can find the full video here.

Essentially, it consists of 2 main concepts; of

Essentially, it consists of 2 main concepts; of

Investment Returns + Speculative Returns

Dividend Yield + Earning Growth +/- Change in PE ratio

Investment Returns = Dividend Yield + Earning Growth

Speculative Returns is the change in emotion of people in the market on how much they are willing to pay.

John Bogle also admitted that no one can predict the future, however he advised investors to stay on course, don't move money here and there, and keep investment simple. These are very good advice.

Sunday, 16 July 2017

Investor Sentiments (July 2017)

How many of us still remember the Asia Financial Crisis which started out of Thailand in 1997? Fast forward, this year is the 20th year since it happened. And today, most of the markets, apart from China, is hitting all time high. Both our sovereign funds released their result last week and they also observed that it is getting difficult to find value in the current market.

Fear and Greed index from CNN money and sentiment survey from AAII.

Fear and Greed index from CNN money and sentiment survey from AAII.

Subscribe to:

Posts (Atom)